Financial Advisors Turn To Model Portfolios As Their Roles Evolve From Stock Picking To Relationship Building

New Escalent data reveals the number of "technical" advisors has dropped to 36% as professionals focus on client acquisition

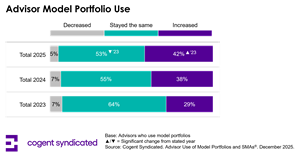

LIVONIA, Mich., Feb. 09, 2026 (GLOBE NEWSWIRE) -- Reliance on model portfolios is rising as financial advisors fundamentally shift their daily focus away from technical investment tasks toward business development. According to the Advisor Use of Model Portfolios and SMAs® report from award-winning analytics and advisory firm Escalent, 42% of advisors using model portfolios increased their usage over the past two years, up significantly from 29% in 2023.

The Advisor Use of Model Portfolios and SMAs® report is an annual study that tracks financial advisors’ use of model portfolios, separately managed accounts (SMAs), and direct indexing. It also examines perceptions of leading model portfolio providers, SMA managers, and direct indexing solutions providers, offering insight into the competitive landscape for third-party model providers and asset managers.

The surge in model portfolio adoption correlates with a decline in advisors identifying as “technical,” defined as spending at least 40% of their time on investment selection and portfolio construction. In 2023, 43% of advisors met this definition. By 2025, that figure dropped to 36%. Conversely, advisors are increasingly prioritizing time for client acquisition and relationship management.

"We are seeing a clear shift where advisors are moving away from the technical aspects of the job to free up time for growing their business," said Meredith Lloyd Rice, a vice president in Escalent’s Cogent Syndicated division. “Momentum is expected to continue, with three in ten advisors planning to rely more on model portfolios over the next year to gain portfolio management efficiency."

The report indicates 82% of model portfolio users now employ portfolios composed of a mix of vehicle types, rather than relying solely on mutual funds. This demand is creating a significant opportunity for Active Exchange Traded Funds (ETFs). Today, current usage of Active ETF model portfolios is low, but consideration is high across numerous providers. Advisors expressed the greatest receptivity to models that blend passively and actively managed ETFs.

Contrary to past skepticism, the study found that older advisors are fueling growth in model portfolio use. While younger advisors (under age 45) remain the heaviest users of model portfolios, the growth momentum is shifting toward older demographics. Among advisors aged 65 and older, the intention to rely more on model portfolios in the coming year nearly doubled, rising from 15% in 2023 to 27% in 2025.

“In a shift from 2024, when younger advisors were the most likely to report increased use, older cohorts are now 'catching up' to modernize their practice. Despite this shifting narrative, there is a distinct disconnect in how value is perceived across generations,” said Lloyd Rice. “Only 38% of advisors over 65 agree that model portfolios help to lower operational costs, compared to two-thirds of their younger peers. As more advisors begin to recognize portfolio management efficiency and increased time for business development as compelling benefits, it's clear that proving the tangible cost-efficiency will be the key hurdle for providers to overcome in reaching universal adoption."

About Advisor Use of Model Portfolios and SMAs®

Cogent Syndicated conducted an online survey with approximately 400 registered financial advisors from September to October 2025. In order to qualify, respondents were required to have an active book of business of at least $5 million and offer investment advice or planning services to individual investors on a fee or transactional basis. Cogent sets quota targets and weights the data to be representative of the overall advisor universe using the Discovery Data Financial Services Industry database as a sample source. Escalent will supply the exact wording of any survey question upon request.

About Escalent

Escalent is an award-winning data analytics and advisory firm specializing in industries facing disruption and business transformation. As catalysts of progress for more than 40 years, we accelerate growth by creating a seamless flow between primary, secondary, syndicated, and internal business data, providing consulting and advisory services from insights through implementation. We are 1,600 team members strong, following the acquisition of C Space and Hall & Partners in April 2023. Escalent is headquartered in Livonia, Michigan, with locations across the US and in Australia, Canada, China, India, Ireland, the Philippines, Singapore, South Africa, UAE and the UK. Visit escalent.co to see how we are helping shape the brands that are reshaping the world.

CONTACT

Alexia Garcia

616.893.2696

agarcia@identitypr.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9fe58eaf-7a64-4f3b-9b4f-d9287e9080be

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.